Reconciliation Reports

The audience for Reconciliation reports is primarily the client’s Accounting and Finance teams. They provide detailed records associated with the financial transactions between PayNearMe and client bank accounts, including credits to the client’s bank account(s) for consumer payments and debits from the client’s bank account(s) for refunds, returns, chargebacks, and reversals.

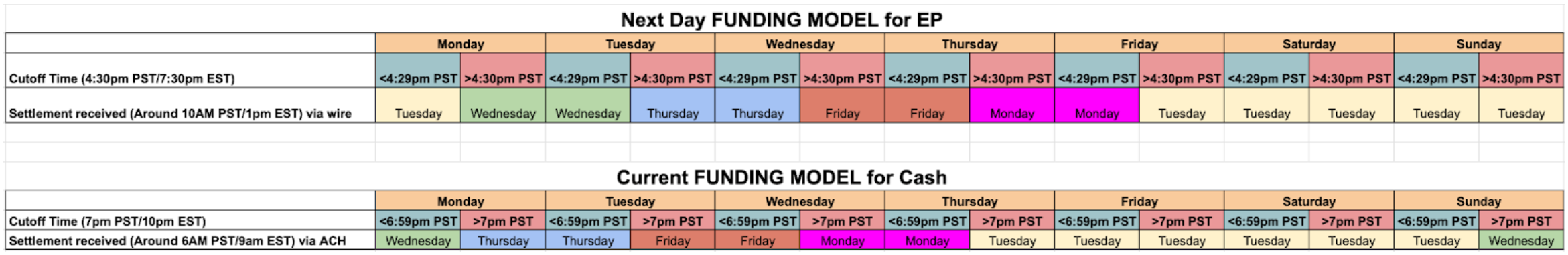

Reconciliation reports support the following funding models:

Electronic Payments Reconciliation Report

The purpose of the Electronic Payments Reconciliation report is to assist your Finance and Accounting departments in reconciling daily electronic payments with the corresponding settlement amounts received in the client’s bank account from PayNearMe. The total amount value at the bottom of the report will match the settlement sum deposited into your bank.

Each record contains:

- Relevant Customer/Payment Identifiers

- Date/Time of Payment

- Fee Breakdown

- Payment Type

Filename and Extension

- Naming convention: recon_7_14_2024_client_bank_name_ep.csv

- Delimited: Comma

Timing

- Frequency: Daily

- Time of Day: TBD

SFTP Details

- Host: sftp://files.paynearme.com

- Username: shared separately

- Password: shared separately

- Sandbox Path: /recon/sandbox

- Production Path: /recon/production

- Port: 22

File Data Specifications

Column | Column Header | Description | Possible Values | Sample Value |

|---|---|---|---|---|

0 |

| Unique PayNearMe generated Consumer Record ID (also referred to as | Integer(13 digits) |

|

1 |

| Unique Customer/Loan ID ( | Integer(7-10 digits) |

|

2 |

| Unique Payment/Transaction ID (also referred to as | Integer(10-12 digits) |

|

3 |

| Payment Date | MM/DD/YY |

|

4 |

| Payment Time | H:MM:SS AM/PM |

|

5 |

| Total Payment Amount (including Fees) | Decimal(6,2) |

|

6 |

| Payment Fee | Decimal(6,2) |

|

7 |

| Net Payment Amount (the amount net of fees that is remitted to your bank) | Decimal(6,2) |

|

8 |

| Specifies what type of electronic payment was made |

|

|

Cash Reconciliation Report

The purpose of this report is for the client’s Finance/Accounting teams to match up each day’s worth of payments with the settlement they receive in the client’s bank account. The total dollar amount at the bottom of the report will match the settlement amount your bank account receives.

Each record contains:

- Relevant Customer/Payment Identifiers

- Date/Time of Payment

- Fee Breakdown

Filename and Extension

- Naming convention: recon_7_14_2023_client_bank_name_cash.csv

- Delimited: Comma

Timing

- Frequency: Daily

- Time of Day: TBD

SFTP Details

- Host: sftp://files.paynearme.com

- Username: shared separately

- Password: shared separately

- Sandbox Path: /recon/sandbox

- Production Path: /recon/production

- Port: 22

File Data Specifications

| Column | Column Header | Description | Possible Values | Sample Value |

|---|---|---|---|---|

| 0 | Order/Auth ID | Unique PayNearMe generated Consumer Record ID (also referred to as pnm_order_identifier) | Integer(13 digits) | 6900197065841 |

| 1 | Site Customer ID | Client Generated Customer/Loan ID (CustNum in MAM file) | Integer(7-10 digits) | 24973734 |

| 2 | PNM Transaction ID | Unique Payment/Transaction ID (also referred to as pnm_payment_identifier) | Integer(10-12 digits) | 990024173001 |

| 3 | PNM Date | Payment Date | MM/DD/YY | 10/13/23 |

| 4 | PNM Time (PST) | Payment Time | H:MM:SS AM/PM | 8:11:21 AM |

| 5 | Principal Amount | Total Payment Amount (including Fees) | Decimal(6,2) | 203.99 |

| 6 | Commissions | Payment Fee | Decimal(6,2) | 3.49 |

| 7 | Net Amount | Net Payment Amount (the amount net of fees that is remitted to your bank) | Decimal(6,2) | 200 |

Adjustments Report

The Adjustment reports contains all Returned (ACH), Reversed (ACH), Charged-back (Debit/Credit), and Refunded payments that are tied to debits from your bank account. Your Finance and Accounting teams can use this report to understand which batches of payment reversals the debits from your bank account are associated with. Canceled payments are not included in this report because they were never settled and thus there are no remitted funds to be pulled back. They are however included in the Returned Payments report because those payments would have been posted and that transaction needs to be undone.

Each record contains:

- Transaction Details: The unique PayNearMe Payment Identifier, along with the precise date and time of the original transaction. The Unique PayNearMe Payment Identifier is the value you should use to tie a transaction in this report to the original payment along with the amount associated with the returned transaction.

- Return Details: Specifies the type of payment being returned (ach, debit) and the specific return category (Chargeback, Refunded, ACH Return)

Filename and Extension

- Naming convention: adjustments_10_14_2023_client_bank_name.csv

- Delimited: Comma

Timing

- Frequency: Daily

- Time of Day: TBD

SFTP Details

- Host: sftp://files.paynearme.com

- Username: shared separately

- Password: shared separately

- Sandbox Path: /recon/sandbox

- Production Path: /recon/production

- Port: 22

File Data Specifications

Column | Column Header | Description | Possible Values | Sample Value |

|---|---|---|---|---|

0 |

| Unique PayNearMe generated Consumer Record ID (also referred to as | Integer(13 digits) |

|

1 |

| Unique Client Generated Customer/Loan ID ( | Integer(7-10 digits) |

|

2 |

| Unique Payment/Transaction ID (also referred to as | Integer(10-12 digits) |

|

3 |

| Payment Date | MM/DD/YY |

|

4 |

| Payment Time | H:MM:SS AM/PM |

|

5 |

| Specifies what type of electronic payment was made |

|

|

6 |

| Total Payment Amount (including Fees) | Decimal(6,2) |

|

7 |

| Payment Fee | Decimal(6,2) |

|

8 |

| Net Payment Amount (the amount net of fees that is remitted to your bank) | Decimal(6,2) |

|

9 |

| Specific return type |

|

|

10 |

| VARCHAR(255) |

| |

11 |

| VARCHAR(255) |

|

Updated 29 days ago